As HISD continues to prepare a budget for the 2018-19 school year, the district anticipates a projected deficit reduction from $208 million to $115 million. This revised deficit includes several budget assumptions related to Hurricane Harvey relief and pending litigation.

When HISD first began budgeting for the 2018-2019 school year, it was in the immediate aftermath of Hurricane Harvey. Using a worst-case scenario, the district’s financial team projected a $208 million deficit based on four dynamic factors: the Local Optional Homestead Exemption (LOHE) lawsuit, a recapture payment to the state, a potential property tax value decreaseand an anticipated student enrollment decline. District administrators crafted a revised budget outlook for the 2018-19 school year.

Community meetings scheduled on budget deficit

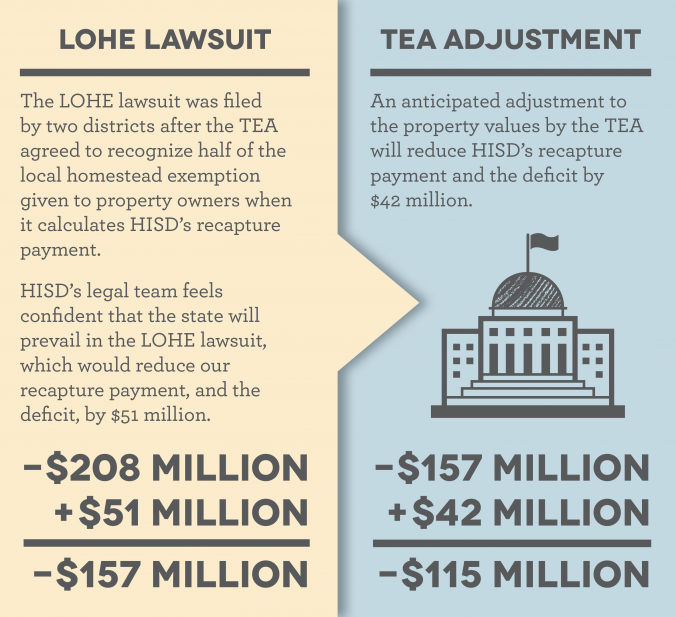

The district’s legal team feels confident that the state will prevail in the LOHE lawsuit. For HISD, this means a reduction in its recapture payment because the TEA will recognize half of the 20 percent local homestead exemption given to homeowners. A decision in the lawsuit could come after a hearing this spring. A win would reduce HISD’s recapture payment by $51 million.

Under the Texas Education Code, TEA Commissioner Mike Morath has the authority to adjust property values. Based on the damage sustained from Hurricane Harvey and the lasting impact of the storm on our students and staff, we anticipate the commissioner will adjust property values, which in turn, would reduce our recapture payment. Governor Greg Abbott, Lt. Governor Dan Patrick, and other state leaders have publicly stated their support for this action. Click here to review a September 2017 press release from Lt. Governor Dan Patrick that confirms his support for schools districts in Region IV impacted by Hurricane Harvey, which includes HISD. In addition, Commissioner Morath surveyed school districts after the hurricane to gather projections on their property tax collections post-Harvey. HISD estimates a $42 million adjustment for property value loss associated with Hurricane Harvey.

In addition, the HISD Board of Education favors a district budget performance review to be conducted by a firm that has previously worked with large school district budgets. An agenda item is anticipated for the April 2018 board meeting. If approved, an immediate audit would begin with a completion date set for the end of the year.